56 Emerging Technologies for Energy-efficiency and GHG Emissions Reduction in the Iron and Steel Industry

Iron and steel manufacturing is one of the most energy-intensive industries worldwide. In addition, use of coal as the primary fuel for iron and steel production means that iron and steel production has among the highest carbon dioxide (CO2) emissions of any industry. According to the International Energy Agency, the iron and steel industry accounts for the largest share – approximately 27 percent – of CO2 emissions from the global manufacturing sector.

China accounts for around half of the world’s steel production. Annual world steel demand is expected to grow from approximately 1,410 million tonnes (Mt) of crude steel in 2010 to approximately 2,200 Mt in 2050. The bulk of this growth will take place in China, India, and other developing countries in Asia (Bellevrat and Menanteau 2008). This significant increase in steel consumption and production will drive a significant increase in the industry’s absolute energy use and CO2 emissions.

Figure 1: World steel production in 2015 by countries and regions (worldsteel 2016)

Figure 1: World steel production in 2015 by countries and regions (worldsteel 2016)Studies have documented the potential to save energy by implementing commercially-available energy-efficiency technologies and measures in the iron and steel industry worldwide. However, today, given the projected continuing increase in absolute steel production, future reductions (e.g., by 2030 or 2050) in absolute energy use and CO2 emissions will require further innovation in this industry. Innovations will likely include development of different processes and materials for steel production or technologies that can economically capture and store the industry’s CO2 emissions. The development of these emerging technologies and their deployment in the market will be a key factor in the iron and steel industry’s mid- and long-term climate change mitigation strategies.

Many studies from around the world have identified sector-specific and cross- energy-efficiency technologies for the iron and steel industry that have already been commercialized (See figure below). However, information is scarce and scattered regarding emerging or advanced energy-efficiency and low-carbon technologies for the steel industry that have not yet been commercialized.

Figure 2: Commercialized energy efficiency technologies and measures for iron and steel industry (Source: IIP, 2012)

Figure 2: Commercialized energy efficiency technologies and measures for iron and steel industry (Source: IIP, 2012)My colleagues at Lawrence Berkeley National Laboratory and I wrote a report that consolidated available information on emerging technologies for the iron and steel industry with the goal of giving engineers, researchers, investors, steel companies, policy makers, and other interested parties easy access to a well-structured database of information on this topic.

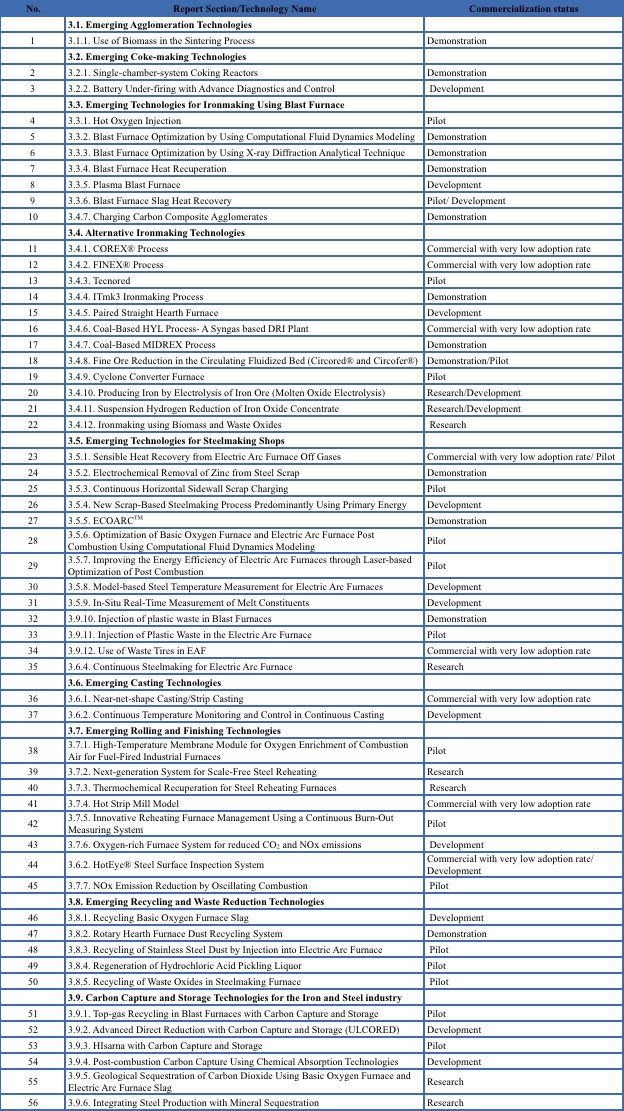

The information about the 56 emerging technologies for the steel industry was covered in the report and was presented using a standard structure for each technology. Table below shows the list of the technologies covered.

Table 1. Emerging energy-efficiency and CO2 emissions-reduction technologies for the iron and steel industry (Hasanbeigi et al. 2013)

Shifting away from conventional processes and products will require a number of developments including: education of producers and consumers; new standards; aggressive research and development to address the issues and barriers confronting emerging technologies; government support and funding for development and deployment of emerging technologies; rules to address the intellectual property issues related to dissemination of new technologies; and financial incentives (e.g. through carbon trading mechanisms) to make emerging low-carbon technologies, which might have a higher initial costs, competitive with the conventional processes and products.

For more information:

Global Efficiency Intelligence